I've touched on this before in other posts, but it is worth highlighting again. The great move from the city to the suburbs has been attributed to various factors: changing lifestyle preferences, the automobile, subsidies to sprawl, urban industrial pollution, etc. While there is probably truth in all of these, possibly the most powerful of them all is greenfield economics. What is greenfield economics? This is simply the set of conditions that flow from building on new territory or exploiting new markets vs. redevelopment of old places, … [Read more...]

Archives for April 2011

The Sprawl Bubble

[ Buffalo's Chuck Banas is a great thinker, doer, and writer on urban matters. He graciously allowed me to repost some of his articles, and this is sadly the last one I have on file. It was written in 2009 and so some of it addresses what was going on at that time, but the perspective remains relevant, even if sprawl is not your issue. - Aaron. ] I’m certainly not the first pundit to comment on the recent economic meltdown, and I sure won’t be the last. But there is a side to this crisis that almost no one is talking about, perhaps because … [Read more...]

The 31-Flavors of Urban Redevelopment

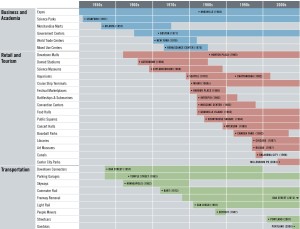

Aaron Renn’s March 24 posting on “The Logic of Failure” and his reference to “silver bullet” solutions for redevelopment and revitalization reminded me of my visit to the “Creative Cities Summit”, about revitalizing cities, three years ago this fall. The setting, timing and venue could not have been better, at least in terms of provoking thought about how to do things better. The setting was Detroit, the time was October, 2008, when the financial markets were crumbling, and the venue was Renaissance Center (“RenCen”), the Robocop-like mixed … [Read more...]