Sign up for Heartland Intelligence, my monthly research briefing on the greater American Midwest. Chicago is known as one of America's great cities for architecture. But other than the Illinois Institute of Technology campus, designed by Mies van der Rohe, very little of the architecture of the South Side is included in the public's mind when thinking about it. Lee Bey, former architecture critic of the Chicago Sun-Times and a South Side residents, aims to change this with his book Southern Exposure: The Overlooked Architecture of Chicago's … [Read more...]

A New Mayor for Chicago and Congestion Pricing for New York

My colleague Nicole Gelinas and I recorded a podcast for City Journal recently about recent developments in New York and Chicago. She talked about New York's approval of congestion pricing and I covered the Chicago mayoral election. If the audio player doesn't display for you, click over to listen on Soundcloud. https://soundcloud.com/aaronrenn/updates-on-chicago-new-mayor-and-new-york-congestion-pricing Subscribe to podcast via iTunes | Soundcloud. Cover image credit: Daniel Schwen, CC BY-SA 4.0 … [Read more...]

Chicago: Past, Present, Future

I gave a talk recently at the Chicago Booth School of Business about Chicago and while I was not able to record it, I decided to reprise my talk as a podcast. I give a very brief narrative overview of the city's history, it's present day strengths, the challenges it faces, and ideas for the future. If the podcast doesn't display for you, click over to listen on Soundcloud. https://soundcloud.com/aaronrenn/chicago-past-present-future Subscribe to podcast via iTunes | Soundcloud. Featured image credit: Daniel Schwen, CC BY-SA 4.0 … [Read more...]

The Tech Campus Moves Downtown

My latest City Journal article from the Winter issue is now online. It's called "The Tech Campus Moves Downtown" and is about states and universities making geographic moves to better position themselves for the 21st century. It talks a lot about the University of Illinois and its Discovery Partners Institute plan, as well as Cornell Tech. Some excerpts: Much of today’s technology economy is located where a critical mass of talent and capital converge: on the campuses of elite research universities, in settings with strong entrepreneurial … [Read more...]

Superstar Effect Wins Again as Amazon Chooses New York, Washington for HQ2/3

Amazon, obviously embarrassed at the way their HQ2 process has been received, leaked the results of the competition the night before Election Day, ensuring coverage will be largely muted. Amazon has reportedly decided to split HQ2 between two locations, New York City (Long Island City, Queens) and Washington (Crystal City, VA). I will have more analysis over the next several days, but this shows that the superstar effect is alive and well. Amazon chose note one but two elite coastal cities for its new headquarters. There's no other way … [Read more...]

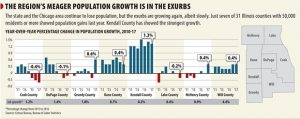

Sprawl Without Growth, Chicago Edition

I recently posted about sprawl in its purest form in Cleveland. Cuyahoga County massively expanded its urbanized footprint while the population remained the same. A couple of recent articles from Crain's Chicago highlight the same thing happening in that city - with the same results in terms of negative filtering of homes and stagnant to declining housing prices. Metro Chicago has lost population for the last two years. But a better way to characterize it is stagnant. The population shrinkage is tiny. On the other hand, the growth that … [Read more...]

Chicago’s $600 Million in Protein Bars

Crain's Chicago reports that a local protein bar company called RxBar is being acquired by Kellogg's for $600 million. RxBar was started by some friends in their early 30s with $10,000 in funds. They initially built it out of their parent's suburban kitchen, then into a commercial space in the city. They now have $120 million in revenue, employ 75, are hiring 40 more, and the owners (and any later investors they may have) are about to become spectacularly rich: Four years ago, Peter Rahal was making protein bars in his parents' Glen Ellyn … [Read more...]

Industrial Past, Industrial Future

The Wall Street Journal had an interesting article about how Chicago's downtown office boom is being fueled by old line industries like food and consumer goods. Like many other major U.S. cities, Chicago is enjoying a boom as big employers opt for downtowns over suburban office parks that are being shunned by young workers. More than $20 billion worth of residential, office, cultural and retail projects are in development or on the drawing board, according to the city Planning and Development Department. But Chicago’s growth engine is … [Read more...]

Caterpillar’s HQ Move to Chicago Shows America’s Double Divide

Earlier today Caterpillar announced that it was moving its corporate headquarters from Peoria to Chicago. The move affects about 300 top-level executives. The company will retain a large presence in Peoria. This is in line with what I've written about before: the rise of the executive headquarters, where a company moves its executive suite (anywhere from 50-500 people) to a major city like Chicago while leaving the back office elsewhere. Chicago has benefitted from this more than any other city I know. In addition to many corporate HQ … [Read more...]

Chicago Mayor Richard M. Daley’s City of Spectacle

Building the City of Spectacle: Mayor Richard M. Daley and the Remaking of Chicago by Costas Spirou and Dennis R. Judd Richard M. Daley took office as mayor of Chicago in 1989. The city was at a low ebb following the bitter racial conflicts of the so-called Council Wars period, when a largely white city council fought to stymie Harold Washington, Chicago’s first black mayor. During Daley’s 22 years in office, many of the Windy City’s neighborhoods gentrified, in part because of a blizzard of municipal-improvement projects originating with … [Read more...]

- 1

- 2

- 3

- …

- 6

- Next Page »