I've been arguing that one thing struggling post-industrial cities need to do is take care of their own business, doing things like addressing legacy liabilities and rebuilding of core public services. Last week I write about Buffalo doing just this by completely re-writing its zoning code and creating a new land use map of the city to bring its planning ordinances up to date for the 21st century. Michael Kimmelman, architecture critic at the New York Times, recently wrote a feature on another good example: the replacement of Detroit's … [Read more...]

How Urban Planning Made Motown Records Possible

I'm reading Once in a Great City: A Detroit Story by David Maraniss, a book I plan to review for City Journal. But I want to highlight something briefly that really caught my eye about Motown Records. It's no secret Detroit punches above its weight in musical influence, and the Motown sound was clearly a big part of that. Maraniss asks "Why Detroit? What gave this city its unmatched creative melody?" He lays out his theory of the case with regards to Motown Records. The family piano's role in the music that flowed out of the … [Read more...]

The Three Generations of Black Mayors in America

[ This week is the Thanksgiving holiday in the US, so I'll be away and enjoying it for the rest of the week. As a holiday long read for you, I'm posting this very important piece about the three generations of black mayors in America and how the timing of the election of the first black mayor affected the trajectory of those cities, with implications even today. Pete is the best writer on urbanism and race that I know and you can read his writings about this and more on his site Corner Side Yard - Aaron. ] The Monument to Joe Louis, … [Read more...]

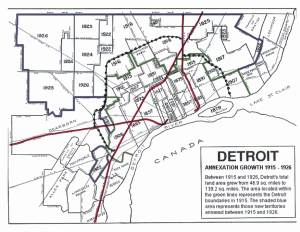

The Uniqueness of Detroit’s Housing Stock

[ I've posted a number of pieces by Pete Saunders here in the past. He's not just a great analyst generally, he's particularly great on Detroit. His post laying out nine reasons why Detroit failed has more page views than any other article in Urbanophile history. (The top four posts are all about Detroit, showing the powerful hold that city has on the public consciousness). In his blog, Corner Side Yard, he's bee revisiting that post to go in depth on each of his nine points. Today I'm pleased to be able to repost his analysis of Detroit's … [Read more...]

What Detroit’s Bankruptcy Teaches America

As has long been expected, the city of Detroit has officially filed for bankruptcy. While many will point to the sui generis nature of the city as a one-industry town with extreme racial polarization and other unique problems, Detroit’s bankruptcy in fact offers several lessons for other states and municipalities across America. The Day of Reckoning Can Take Much Longer Than We Think to Come What’s most surprising about Detroit’s bankruptcy is not that it happened, but how long it took to get there. In authorizing the bankruptcy filing … [Read more...]

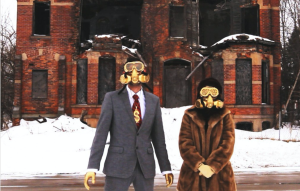

Film Review: Detropia

Trailer for Detropia. If the video doesn't display, click here.I was lucky to get to see Detropia, a buzz-laden documentary about Detroit, at the UMass-Boston film series, where Heidi Ewing, one of the film makers, was present for a post-screening discussion. Ewing, incidentally, grew up in suburban Detroit. The title is an interesting word play. It's a portmanteau of ambiguous meaning. It could be a combination of "Detroit" with either "utopia" or "dystopia," though as the bleak civic outlook suggests, the latter is far more appropriate. … [Read more...]

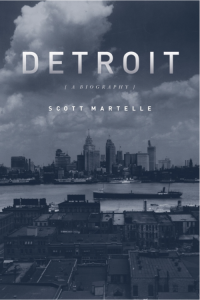

Detroit: A Biography

[ You may remember Pete Saunders from his piece on the reasons behind Detroit's behind. I've long found Pete's insights provocative. I'm glad to report he is now blogging himself on his own blog called "The Corner Side Yard." Today he graciously shares another Detroit piece for us here, this time a review of Scott Martelle's new book, "Detroit: A Biography" - Aaron. ] When I first got my review copy of Detroit: A Biography by Scott Martelle, I did the unthinkable: I started by reading the epilogue. I wanted to know right from the start where … [Read more...]

Nine Reasons Why Detroit Failed

My hometown of Detroit has been studied obsessively for years by writers and researchers of all types to gain insight into the Motor City’s decline. Indeed, it seems to have become a favorite pastime for urbanists of all stripes. How could such an economic powerhouse, a uniquely American city, so utterly collapse? Most analysis tends to focus on the economic, social and political reasons for the downfall. One of my favorite treatises on Detroit is The Origins of the Urban Crisis by Thomas Sugrue, who argues that housing and racial … [Read more...]

Yes There Are Grocery Stores in Detroit

[ I'm delighted to be able to share with you today a story from Jim Griffioen, a simply wonderful writer living in Detroit and author of Sweet Juniper, which is not exactly an urbanist blog, but like everything in Detroit is simply unlike anything else out there - and in a good way. I know you'll enjoy it - Aaron. ] I'm just one of about 800,000 people still living in the city of Detroit, Michigan, the nation's 11th most-populated city. Because of the events of the last half century, this is a city that journalists and academics love to … [Read more...]

The Other Side of Detroit

That picture is of a house in the city of Detroit. Surprised? Don't be. Detroit actually contains numerous intact neighborhoods ranging from working class to upscale. These are seldom shown in the voluminous photo tours of the city that tend to focus exclusively on decay, and too often on the same handful of sites such as Michigan Central Station, a practice Vice Magazine dubbed "ruin porn." The decay is there. The collapse is real. That is the story. But it's not the whole story. Amid the truly legitimate and titanic struggles of Detroit … [Read more...]